Numerous sector publications such as Advisor, Azienda Banca, Focus Risparmio and Economy Magazine highlight the new research by Excellence – available directly below – which highlights how banks, by focusing more on financial advice, are able to reduce liquidity in current accounts .

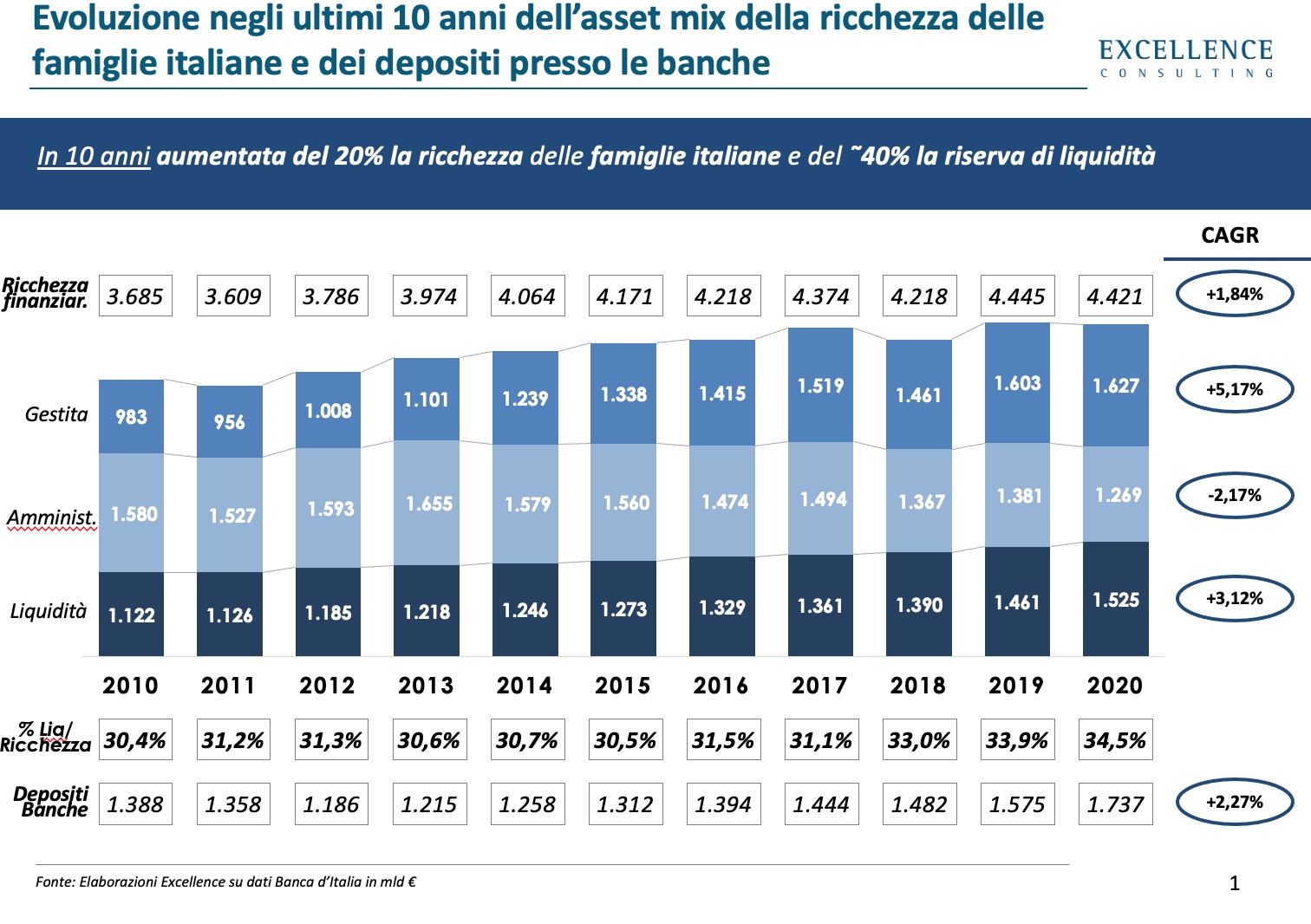

In the last ten years, from 2010 to 2020, the share of liquidity in Italian current accounts, including households and businesses, has grown by around 3% reaching the figure of 1,750 billion, a value which, due to the negative interest rates imposed by ECB policies, push banks to apply additional costs: Fineco has announced its intention to close deposits above 100 thousand euros and other intermediaries (Banco BPM, BNL, BPER, MPS, Unicredit) are recommending similar initiatives.

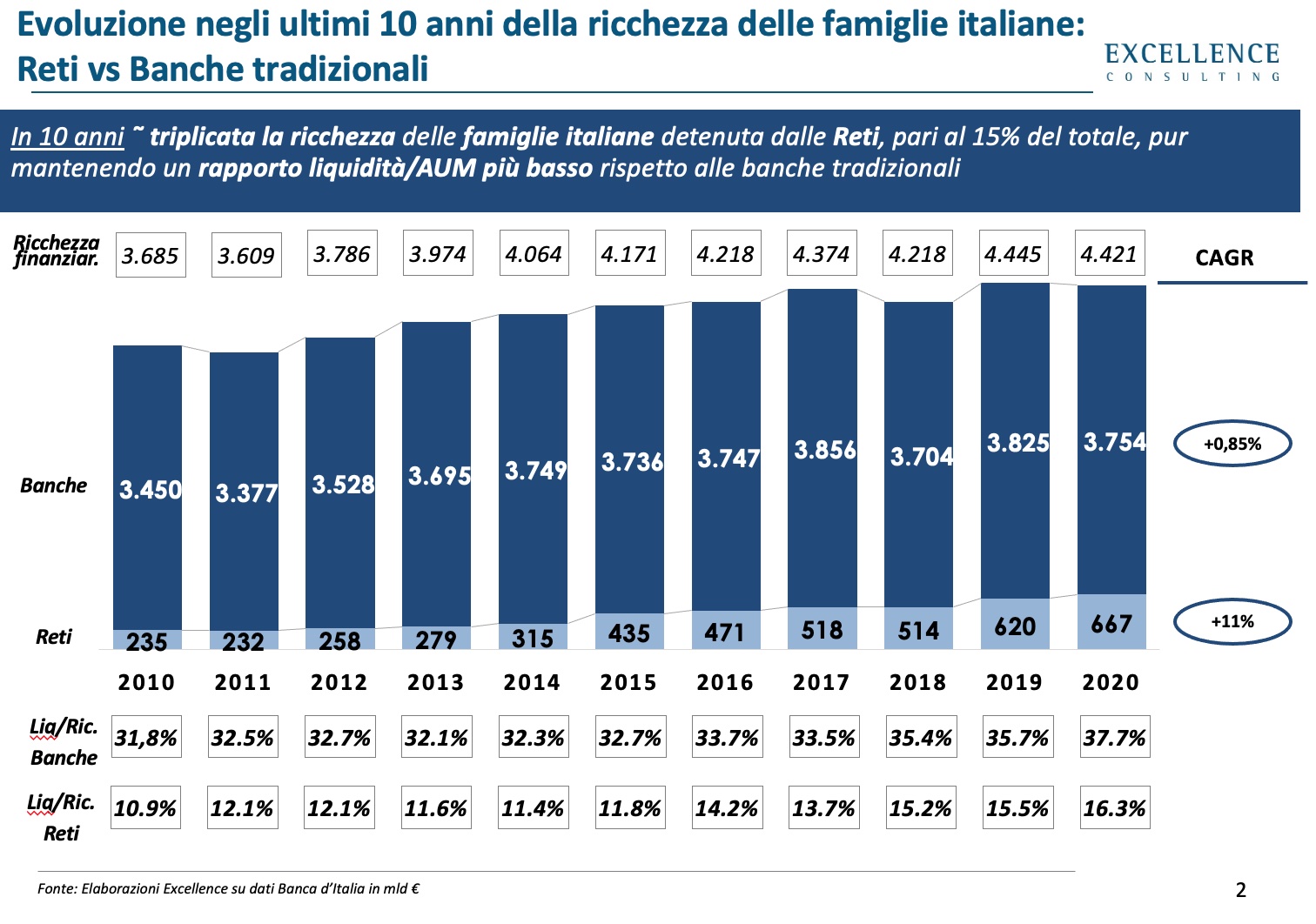

On the other hand, again from 2010 to 2020, the financial wealth of Italian families, amounting to 4,421 billion, increased by only 1.84%. The ability of the network banks (Fideuram, Mediolanum, Fineco, Banca Generali, Allianz Bank, etc.) to advise customers on the management of their financial wealth, with the consequent allocation of assets towards asset management products, has enabled them to stem the ‘increase in liquidity: in 2020 for the networks, the percentage of the latter with respect to customer wealth under management was in the order of 16% against 38% for the rest of the banking system (Intesa Sanpaolo, Unicredit, Banco BPM, MPS , BPER etc.).

This is what emerges from a research by Excellence Consulting, which examines the relationship between increased liquidity and the various business models of banks.

In the last year, according to ABI, the deposits of Italians have increased by around 200 billion euros. The pandemic has prompted people to be more cautious, save more and fear the volatility and instability of the markets, so the decline in GDP following the lock-down has also been associated with the reduced expansion of financial wealth. Looking at Bankitalia’s data, if it is true that from 2010 to 2020 the share of the latter held in the form of liquidity by Italian households grew by around 3% per year, however the trend shows a progressive acceleration: up to to 2015 the increase was in the order of 1.27% per year, from 2015 to 2018 by 3%, to reach 4.74% in the two-year period 2018-2020. The key year seems to be 2015, that of bank failures with the resolution of Banca Etruria, Banca delle Marche, Cariferrara and Carichieti, but there is no doubt that the uncertainty due to the health crisis has also greatly accelerated growth in the last two years . At the same time, the share of financial wealth held in the form of asset management products (mutual funds or insurance products) has also grown, reporting an annual growth rate of 5.17% from 2010 to 2020, nevertheless the overall financial wealth of Italians , equal to 4,421 billion in 2020, has increased by only 1.84% per year in the last ten years.

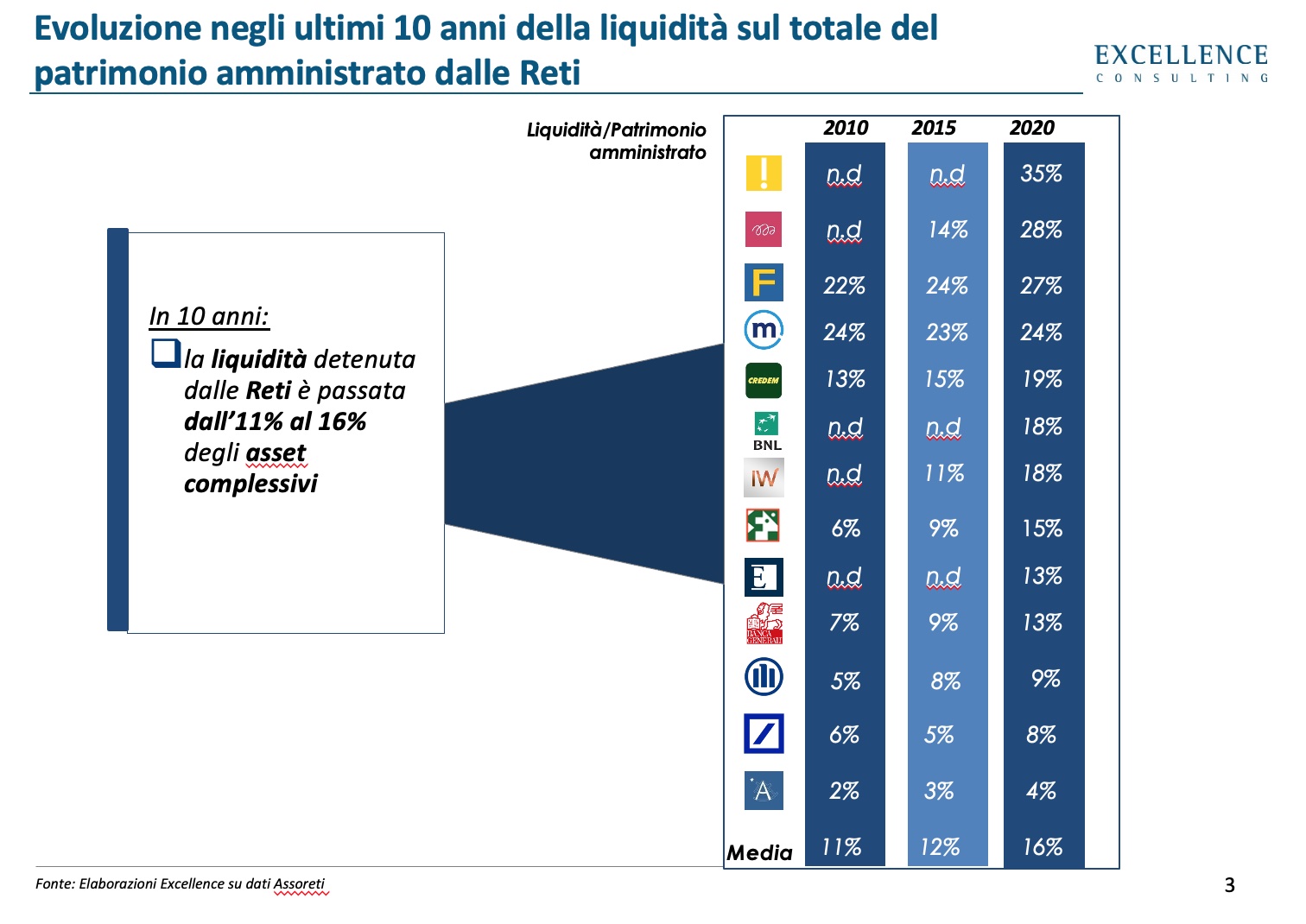

The traditional consultancy attitude of the Networks on the management of customers’ financial wealth, i.e. the ability to ensure that part of it is mainly invested in asset management products, has allowed them to contain the increase in liquidity: in fact, by 2020 for the Networks (Fideuram, Mediolanum, Fineco, Banca Generali, Allianz Bank etc.) the share of liquidity with respect to the total financial wealth of their customers was in the order of 16%, compared to the same indicator for the rest of the banking system (Intesa Sanpaolo, Unicredit, Banco BPM, MPS, BPER, etc.) equal to 38%. The increase, however, concerned all market players: from 2010 to 2020, the indicator rose from 11% to 16% for networks, while for banks it rose from 32% to approximately 38%. Even within the Networks, the situation is not homogeneous. Looking to 2020, the best performers in terms of liquidity share of total customer assets were: Azimut (4%), Deutsche Bank (8%), Allianz Bank (9%), Banca Generali (13% ), Banca Euromobiliare (13%) and Fideuram (15%). They have a more significant weight of liquidity: CheBanca (35%), Wibida (28%), Fineco (27%), Mediolanum (24%).

“Our research – says Maurizio Primanni, CEO of Excellence Consulting – demonstrates that the liquidity not used for income that lies in the current accounts of Italians, as well as the fear and uncertainty in the future resulting from the Covid emergency, is also linked to the greater or lesser capacity of the Bank to provide consultancy. In particular, it should be noted that the problem of excess liquidity on customer accounts concerns commercial banks more than the Networks, which benefit, in addition to having a richer average customer base, also from a greater focus of their model towards client investment advice. It is also interesting that within the aggregate of network banks the situation is uneven, with the advisor-centric ones (Fideuram, Banca Generali, Allianz Bank and Azimut) affected by the problem of excess liquidity to a much lesser extent than the more digital (Fineco, Widiba and Che Banca).”