by Davide Olivieri and Carlo Liotti, respectively Associate Manager and Partner in Excellence Payments

The payments market in Italy and Europe

Over the last five years, the digital payments market has recorded significant growth, driven both by structural factors, primarily the introduction of the PSD and the related regulatory context, and by contingent factors, such as the pandemic. The main indicators of the sector confirm this growth: the volumes transacted reached 438 billion euros (+80% from 2019) and the number of cards issued (credit, debit and prepaid) exceeded 115 million (+17% from 2019 ). This growth has also been reflected in an increase in companies operating in Italy, with 55 institutes (IMEL and IP) authorized, of which approximately 50% have been approved in the last five years.

At the same time, many operators active in Italy (e.g. Satispay authorized in Luxembourg) have chosen small European financial hubs, such as Luxembourg, Lithuania and Malta. Despite operating within the same regulatory framework, these countries stand out for more streamlined authorization processes and more favorable conditions for the development of new business initiatives. Consequently, although the number of EMI authorizations is growing in Italy, the pace remains lower than that of these hubs, which manage to attract Italian and foreign operators. This raises questions about the impact of the regulatory environment on the competitiveness levels of the Italian market, despite the opportunities offered by an expanding market.

Comparison of European IMEL openings

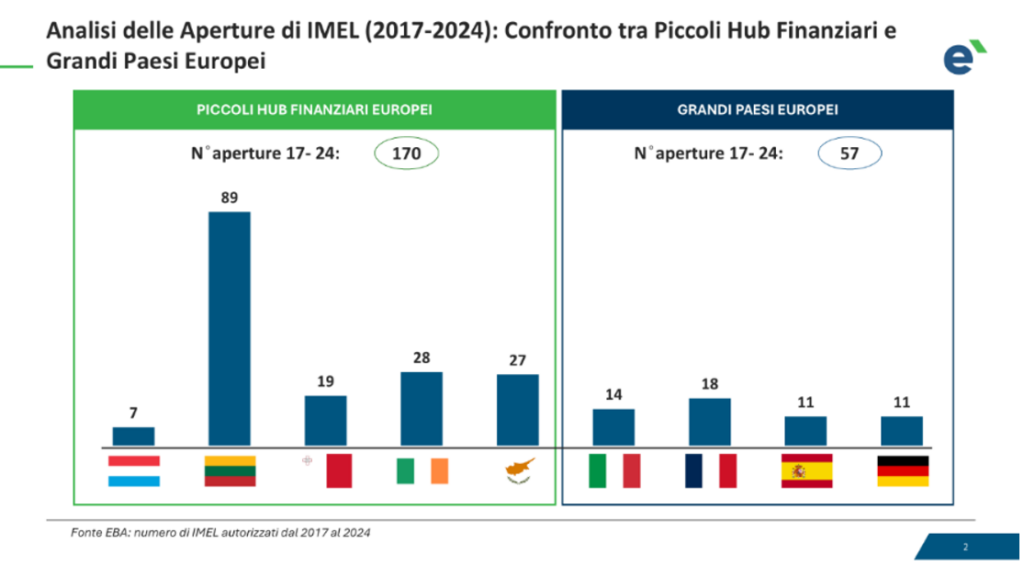

These small hubs have been the driving force behind EMI growth in Europe, with 170 new openings between 2017 and 2024, according to EBA data (chart below). Lithuania leads this expansion with 89 authorizations, a number that alone exceeds the overall number of openings in large European countries (France, Italy, Germany and Spain) in the same period.

The choice of small European financial hubs is motivated by certain times and reduced process costs, which allow scaling towards larger markets such as France, Italy or Germany, where much of the demand for the services they offer is concentrated.

This dualism between small agile hubs and large mature markets benefits the former, capable of offering a more competitive ecosystem, capable of promoting innovation through a combination of quality of execution and competitive costs.

This gives rise to the phenomenon called “forum shopping”, i.e. the strategic choice of obtaining the license in countries where costs and implementation times are lower and certain. This phenomenon is also linked to regulatory arbitrage, where EMIs exploit differences between the regulatory frameworks of various Member States to obtain more favorable conditions. Once authorized in a European Union country, companies can operate freely in all other member states, thanks to the “European passport” principle.

This regulatory fragmentation between countries highlights the need to harmonize European rules and simplify processes, an objective that PSD3 aims to achieve. The new European directive, in fact, could act as a catalyst to reduce barriers and standardize the conditions of access to markets in the various member states.

Interpretative rigidity in Italy

In Italy, the authorization process for EMIs stands out for its complexity and duration. The process takes longer than in other European countries, generally over 12 months, characterized by stringent governance and compliance requirements. An example above all is the request for in-depth checks on direct and indirect investors, on the members of the Board of Directors and on the composition of the capital which are not foreseen in other states. Together with Italy, other large European countries, such as France and Germany, present similar processes.

Small hubs have less onerous and more efficient processes. In Lithuania, for example, the process is among the fastest, lasting approximately 3-6 months, thanks to the use of a centralized online “Regulatory Gateaway” system managed by the Bank of Lithuania. This system allows you to send documents, monitor the status of requests and receive responses in a completely digital way, significantly reducing administrative times and costs.

In Ireland, the authorization process for EMIs generally lasts between 6 and 12 months. The country is known for competitive taxation and a regulatory framework that balances rigor and flexibility.

Cyprus, on the other hand, offers intermediate times of 6-9 months, focusing on anti-money laundering (AML) and countering the financing of terrorism (CFT) regulations, as well as presenting attractive taxation.

What future for the Italian market?

In 2023, Italy recorded a growth of 13.4% compared to the previous year in per capita transactions with instruments other than cash, reaching an average of 199 transactions. A figure that is still far from the euro area average, where 394 transactions per capita are recorded and which measures the development opportunity present in our country which is showing a growing propensity to adopt electronic payment instruments. This growth potential makes Italy a promising market for the entry of new operators and the development of IMEL.

The new rules introduced by PSD3 and the Payment Services Regulation (PSR) aim to eliminate differences in interpretation between member states, encouraging a more uniform competitive environment. The regulatory framework distinguishes between the daily operational rules of payment institutions (managed by the PSR) and those relating to the authorization and supervision of EMIs (governed by the PSD3), improving clarity and consistency without compromising security and transparency.

This regulatory evolution, together with the growth of the market, offers a unique opportunity to encourage the creation of new institutions as long as the objective of adopting faster processes is set in Italy too. This is to meet the expectations of those operators ready to invest in our market, rather than heading towards more competitive hubs.

With a large and expanding market, growing demand and an increasingly favorable European regulatory context, Italy can become a point of reference for innovation in digital payments, transforming this potential into reality and positioning itself among the main hubs for EMIs in the European market.