by Carlo Liotti, Partner at Excellence Payments

Although in recent years, on the topic at hand, the focus has… shifting from pure acceptance to solutions that combine payments with business management and customer engagement, up to financing options and payment splitting for the buyer (Buy Now Pay Later).

What better chance for our markets to observe, decode and bring home what is already happening in more advanced geographies… so we can be timely and proactive rather than perpetually late and reactive?

Across Europe there is already a growing trend of offerings in the area of “merchant services” that go beyond simple acquiring… bundling software, hardware and value-added services, with different revenue logics and relationship models embedded in the merchant-services offer.

One clear example is the so-called vertical integrations that connect cash-desk/POS software with payment acceptance and back-office functions… players that in the U.S. and the U.K. have long offered integrated solutions and are gaining share.

(1) in Germany an hospitality/retail ecosystem is starting to take shape… (2) in the U.K./U.S. restaurant platforms are evolving from POS to full suites with embedded payments… (3) “Tap to Pay”/Stripe for restaurants with an integrated payments dashboard.

Integrated payments and the rise of a new value chain

We are increasingly witnessing an evolutionary process in which merchants choose their vertical software first and only afterwards the acquiring component… and they accept to pay fees well above standard rates when the solution removes friction and adds tangible value.

It is therefore ever more true that partnerships with ISV (Independent Software Vendor) players (and, in some cases, outright M&A) become central… just think of Fiserv’s acquisition of Clover, or of U.S. Bank’s acquisition of Talech (POS software).

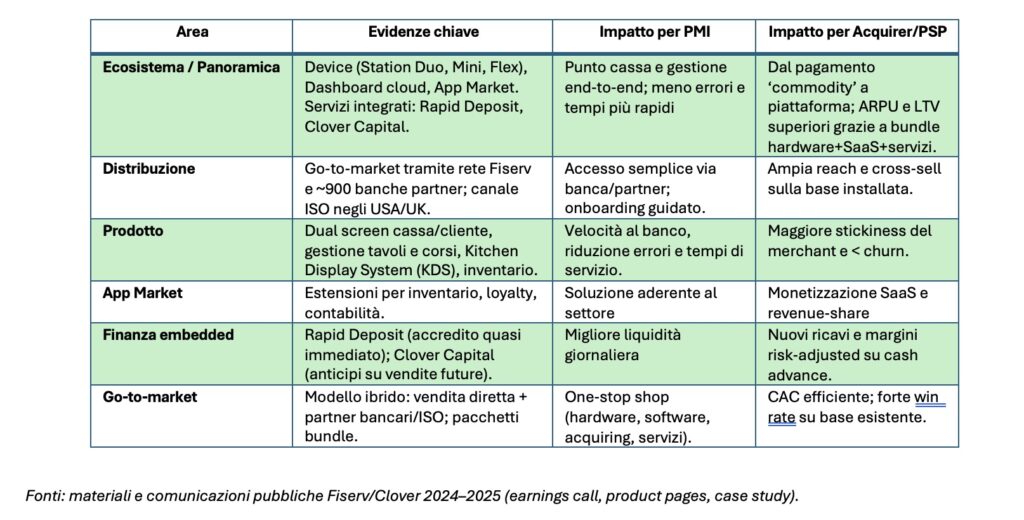

Clover is Fiserv’s POS ecosystem: devices (Station Duo/Flex/Mini), cloud dashboard, App Market… integrated services such as Rapid Deposit (near-instant settlement) and Clover Capital (cash advances on future sales) to support investments and seasonal peaks.

Area

Key evidence — Impact for SMEs — Impact for Acquirer/PSP

Sources: public Fiserv/Clover 2024–2025 materials (earnings calls, product pages, case studies).

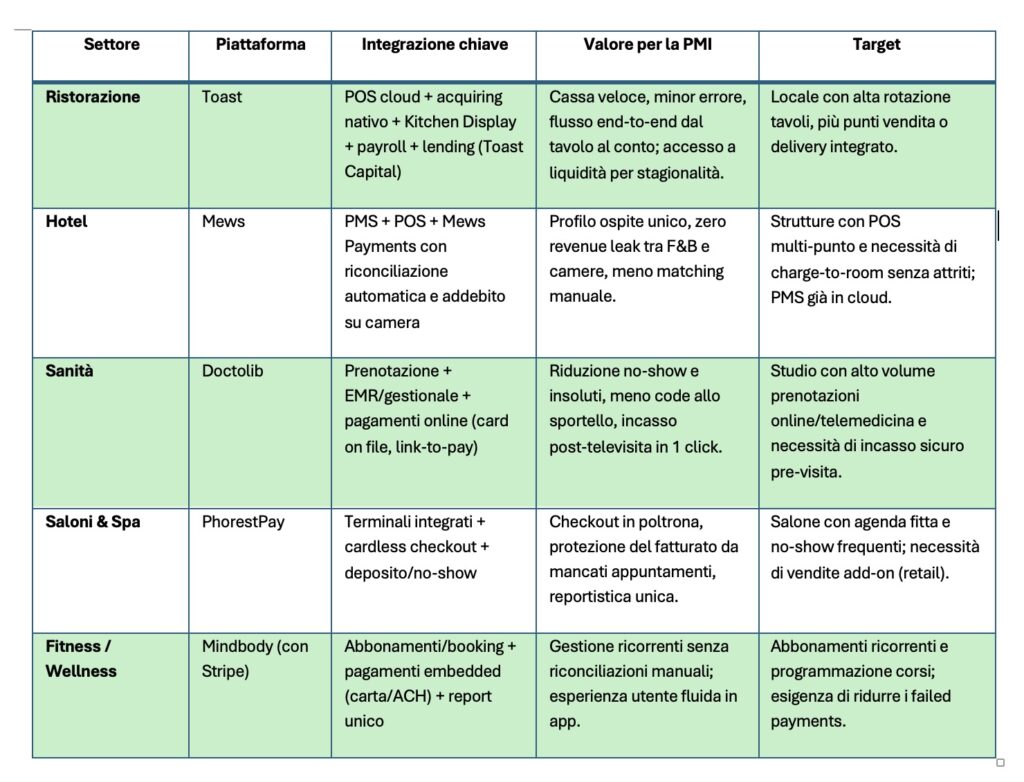

Vertical specialization

A further piece of evidence concerns some acquirers that have… chosen to bring dedicated vertical solutions to market; merchants, in turn, are willing to pay a premium in order to have a solution tailored to their own sector.

Examples

Rethinking the “go-to-market”

To compete in this new context, initiatives must… evolve from pure price-based selling to advisory-led selling, packaging services that require ever greater specialization.

And we are already seeing, at some of the more sensitive organizations, the… creation of sector squads, partnerships for solution distribution, and data sharing agreements on which to build lead-generation campaigns).

Italy, too, is no stranger to this necessary change… the winners in the race to serve the SME market will be those who move first, build ecosystems and industrialize the go-to-market.